Mid 2023 Recreational Vehicle Industry M&A Report

This article is a summary of recent M&A activity in the recreational vehicle industry in 2023.

The recreational vehicle industry is coming off two of the most profitable and demanding years in a row. The effects of the COVID-19 pandemic and economic shutdown greatly benefited all aspects of the industry, from manufacturers, dealers, repairs, and campgrounds. The companies that were ready capitalized greatly and added a new generation of customers to its base. But now what? 2023 is proving to be a very different year for all involved.

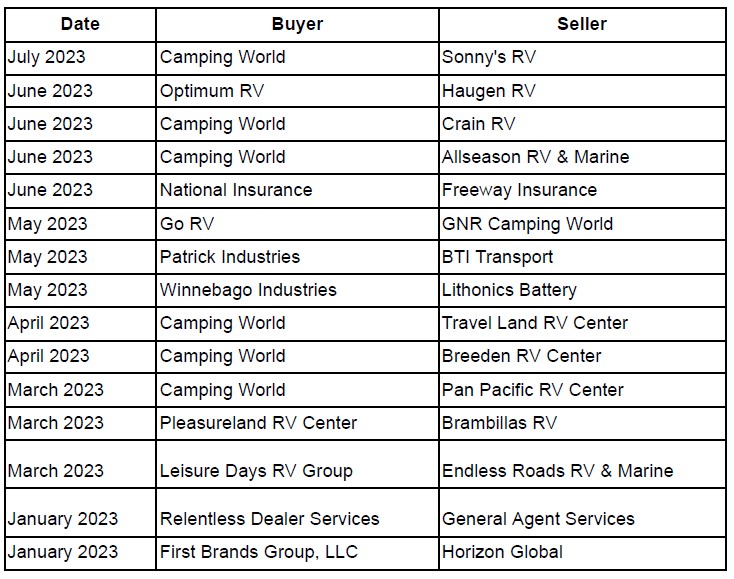

Recent Mergers and Acquisitions

Despite the recent slowdown in the RV industry as a whole, mergers, and acquisitions are still going strong. Marcus Lemonis, Chairman and CEO of Camping World, recently said, “Our goal is to achieve 50% growth in our store count over the next five years”. Camping World is currently the largest retailer of RVs and has 197 store locations. Many other conglomerates are looking to expand via acquisitions and new store openings.

By Craig Hudman, Managing Director at Jackim Woods & Co.

By Craig Hudman, Managing Director at Jackim Woods & Co.

Jackim Woods & Co. is a leading mergers and acquisition advisor focused on providing senior-level attention and flawless execution to clients in the recreational vehicle industry.

Craig is an experienced mergers & acquisitions professional, a former owner of a leading RV dealer, and a dealership management and operations expert. He brings over 30 years of RV-related experience.

To arrange a free, confidential initial consultation, please contact Craig Hudman at (208)521-1521 or chudman@jackimwoods.com.

Read More

Kahoot Goes Private for $1.7 Billion in All Cash Deal

The popular education game developer Kahoot has gone private in a $1.7 billion all-cash deal.

At that valuation, the buyers of Kahoot, an Oslo-based developer that built and runs the popular quiz tool, paid a significant premium. But it’s still below the company’s COVID-era valuation, which valued the company at closer to $6 billion.

The Kahoot buyer group was led by Goldman Sachs’ private equity arm, with General Atlantic, KIRKBI Invest A/S (of LEGO Group), and Glitrafjord named as major investors.

Kahoot was listed on the Oslo Stock Exchange and went public in 2021. That same year, Kahoot acquired Clever, a platform developer that streamlined the edtech experience for schools, and according to their websites, says it serves half of all K-12 students in the U.S.

The premium price paid for Kahoot is an exception to the rule these days, as edtech companies find themselves in a more conversation valuation climate than the valuations paid during the pandemic. The visions many investors had of unlimited edtech growth, which fueled crazy valuations like Byju’s, have fallen apart, says Rich Jackim of Jackim Woods & Company, and valuations have returned to the more normal valuations seen for other SaaS companies.

In Jackim’s estimation, the new owners are likely to draw Kahoot and Clever farther from their roots, which raises questions about what the future direction of the company will be and whether Kahoot will continue to offer the Clever platform to schools for free for much longer.

In Jackim’s estimation, the new owners are likely to draw Kahoot and Clever farther from their roots, which raises questions about what the future direction of the company will be and whether Kahoot will continue to offer the Clever platform to schools for free for much longer.

If you own an education, training or edtech company and would like to explore your options, please contact Rich Jackim at rjackim@jackimwoods.com or 224-513-5142.

Read More

Mid 2023 Recreational Vehicle Industry Report

The recreational vehicle industry is coming off two of the most profitable and demanding years in a row. The effects of the COVID-19 pandemic and economic shutdown greatly benefited all aspects of the industry, from manufacturers, dealers, repairs, and campgrounds. The companies that were ready capitalized greatly and added a new generation of customers to their base. But now what? 2023 is proving to be a very different year for all involved.

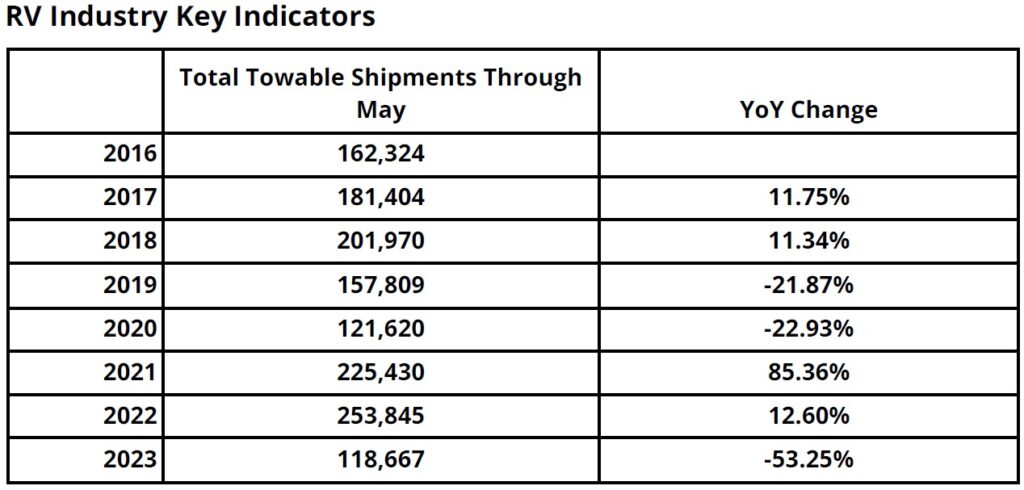

The RV Industry as a whole is seeing the effects of record sales in the past two years. Sales have plummeted in part to the rising costs of RV and interest rate hikes. RV shipments in 2023 are at their lowest point since 2007-2008. Many dealers are still struggling to move new 2022 model year units while manufacturers slowly roll out 2024 model years. Projections put shipments in 2023 around 300,000 and 2024 in the mid 300’s. This added on top of interest rates that have nearly doubled over the last twelve months, and a poor national economic outlook has put most would-be buyers on hold. Interest rates are not expected to decrease until the latter part of 2024.

The RV Industry as a whole had an overall economic impact of $140 billion in 2022. More Americans are discovering the joys of camping. The average use of an RV is around 20 days per year. Manufacturers, Dealers and Campgrounds are staying busy with the huge influx of new buyers coming to the RV market as a result of the COVID-19 pandemic. These new customers are keeping both campgrounds and dealerships busy, not to mention the added strain on manufacturers and suppliers.

Thor, Forest River, and Winnebago account for 90% of all RV’s manufactured in the U.S. and Canada. These three “big” manufacturers continue to dominate and account for all brands commonly sold on most dealers’ lots. Towables account for close to 90% of the market, and the other 10% is motorized. Thor leads the way in towables and motorized market share, and Forest River is number two. The largest segment growth comes in the motorized class B with growth of around 8% per year. Winnebago currently claims 39% of this market. Texas continues to be the number one destination for wholesale RV shipments at nearly 10%, followed by California (6.4%), Florida (6.1%), Ohio (3.6%), and Michigan (3.5%). The median age for RV buyers has dropped to 33 years old. The amount financed on an RV has risen to around $45,000.

By Craig Hudman, Managing Director at Jackim Woods & Co., a leading mergers and acquisition advisor focused on providing senior-level attention and flawless execution to clients in the recreational vehicle industry.

By Craig Hudman, Managing Director at Jackim Woods & Co., a leading mergers and acquisition advisor focused on providing senior-level attention and flawless execution to clients in the recreational vehicle industry.

Craig is an experienced mergers & acquisitions professional, a former owner of a leading RV dealer, and a dealership management and operations expert. He brings over 30 years of RV-related experience.

To arrange a free, confidential initial consultation, please contact Craig Hudman at (208)521-1521 or chudman@jackimwoods.com.

Read More

You Don’t Know What You Don’t Know: Selling an RV Dealer

If you’ve ever heard the saying, “You don’t know, what you don’t know,” and never understood it, I was there also. I sold my family business about 18 months ago to a much larger company. At the time, I thought that knew a lot about the RV industry, after all, I was a third-generation owner. I figured if my grandfather and father had been successful for over 50 years, what they’d taught me ought to be enough. That idea, that concept embedded into the depths of my thought, couldn’t have been more wrong. I soon would learn “what I didn’t know.”

The first six months were really a blur. Our projections and goals were constantly changing based on more growth than I ever could’ve imagined. All of the new tools and information I now had at my disposal were amazing. Any question I had could be answered, and hunches could now be backed up with quantifiable data. I’ll admit it was a bit of an overload at first, but now it has become normal.

To people that have been brought into the light after having been in the dark, the world seems amazing, and this is how I felt. Along with this amazing feeling also comes a bit of shame. I now can say, “I didn’t know what I now know.” Shame comes from knowing that in 50 years of business, we never truly grew. Not when I came home from college with all my “fancy” degrees and learning. Not from an evolving economy. We only focused on small, consistent growth that was very risk-averse and preservation-minded. Debt was always considered bad. Sure, we made a great living, but now I know what could’ve been.

So to all those out there who “don’t know what you don’t know,” I suggest you learn before it cost you as much as it cost me. Sure, it cost me in the valuation of my company, but most of all, it cost me years of personal and professional growth. Now I am always searching for ways to improve, so if I am ever in the same position, my “don’t know” won’t last very long.

So to all those out there who “don’t know what you don’t know,” I suggest you learn before it cost you as much as it cost me. Sure, it cost me in the valuation of my company, but most of all, it cost me years of personal and professional growth. Now I am always searching for ways to improve, so if I am ever in the same position, my “don’t know” won’t last very long.

If you own an RV dealer, supplier, or OEM and would like to explore your growth options or exit options, I would welcome an opportunity to speak with you. Feel free to contact me for a confidential, no-cost, no-obligation consultation at chudman@jackimwoods.com or 208-521-1521. I look forward to speaking with you.

Read More

Selecting the Right Expert Witness Can Win Your Case

Proven and Experienced Expert Witness Services

If you are representing a plaintiff or defendant in litigation, selecting the right expert witness can make or break your case. Knowing how to pick the right expert is key to obtaining a successful outcome.

The right expert witness in the mergers and acquisitions industry goes beyond just ensuring that the witness has the right education and training to calculate financial and economic damages. It is equally important that the expert understands the operations, finances, and practices in the business brokerage and M&A industry and is familiar with the issues that affect privately held businesses and professional practices.

Expert Witness Areas of Expertise

- Business valuations of privately owned businesses

- Franchisor and franchisee disputes

- Calculation of economic damages

- Purchase price allocation

- Valuation of personal goodwill in professional practices

- Earnout disputes

- Lender or creditor disputes

- Shareholder disputes

- Divorce settlements

- Bankruptcy

- Valuation of intangible assets like fitness center membership lists, brand value, or goodwill

Selecting the Right Expert to Help You Win Your Case

Expert witnesses are a dime a dozen, but when you need an expert with a very specific set of skills or experience, like expertise in business valuation and mergers and acquisitions issues related to buying and selling privately-held companies, clients and their law firms, select Jackim Woods & Company.

When selecting an expert witness in the mergers and acquisitions space, it is critical that you and your attorney know exactly what skills and experience your expert witness needs to have. Richard Jackim, the founder and managing partner at Jackim Woods & Co, is an experienced investment banker and a retired mergers & acquisitions attorney. He has been involved in over 100 mergers and acquisitions in over 20 different industries. He has performed over 290 business valuations and served as an expert witness in dozens of litigation matters.

When selecting an expert witness in the mergers and acquisitions space, it is critical that you and your attorney know exactly what skills and experience your expert witness needs to have. Richard Jackim, the founder and managing partner at Jackim Woods & Co, is an experienced investment banker and a retired mergers & acquisitions attorney. He has been involved in over 100 mergers and acquisitions in over 20 different industries. He has performed over 290 business valuations and served as an expert witness in dozens of litigation matters.

Rich Jackim has the credentials and experience you need to win your case. Rich earned his law degree with honors from Cornell University Law School and his Master of Business Administration with honors from the Kellogg Graduate School of Management at Northwestern University. Rich also founded the Exit Planning Institute, a training and certification company that is the thought leader in the field of exit planning. He developed and taught the Certified Exit Planning Advisor program offered through the Booth School of Business at the University of Chicago. He is also the author of the critically acclaimed book, The $10 Trillion Opportunity: Designing Successful Exit Strategies for Middle Market Business Owners.

A copy of Rich Jackim’s expert witness curriculum vitae is available here.

Communication Skills Win Cases

In addition to the right credentials, an effective expert witness must be able to communicate in a clear, concise, and articulate manner. Your expert witness must come across as knowledgeable, accessible, and self-assured without being pedantic. The ability to build rapport with the judge and jury is essential. When both sides present strong, technically sound positions, a judge or jury often favors the side whose expert was able to communicate the issues more clearly or convincingly. Richard Jackim is a personable and knowledgeable expert and has a unique ability to present complicated issues in a clear and concise manner that connects with judges and juries.

We offer clients and their attorney’s a free, one-hour initial assessment of their case so they can determine if our approach and communication style meets their needs.

Credibility Wins Cases

An expert must also be polished and unflappable in the face of tough, sometimes seemingly stupid questions from opposing counsel. An expert witness must be able to answer questions about his background and experience to withstand a Daubert challenge. It’s critical for the attorney to have an upfront conversation with the expert to ensure they are of good character; have worked for both plaintiffs and defendants; learn about any positions they may have taken that are adverse to the position in this case, whether through testimony or through publications of an article; and whether they have ever failed a Daubert challenge.

Richard Jackim’s top-tier academic credentials, plus his 30 years of business experience, including practicing mergers & acquisitions law and leadership positions at several national investment banking firms, provide him with unique qualifications as an expert witness. His opinions are based on market realities and actual transactions, not just financial theories. As a result, he can speak to industry best practices and what is “market.”

Practical Industry Experience Wins Cases

It’s also important that you select an expert witness who has industry-specific experience as well as experience testifying in depositions, hearings, and at trial. This experience enables them to have a clear understanding of the business being evaluated, gives them an advantage by being able to understand how litigation and depositions work, allows them to anticipate the kinds of questions opposing counsel might ask, and helps you and your attorney understand the key weaknesses in the opposing expert’s presentation.

It’s also important that you select an expert witness who has industry-specific experience as well as experience testifying in depositions, hearings, and at trial. This experience enables them to have a clear understanding of the business being evaluated, gives them an advantage by being able to understand how litigation and depositions work, allows them to anticipate the kinds of questions opposing counsel might ask, and helps you and your attorney understand the key weaknesses in the opposing expert’s presentation.

Rich Jackim has worked with hundreds of clients in over 20 different industries, including career and vocational education, sports & fitness, manufacturing, professional services, trucking and transportation, and the wholesale/distribution sectors.

He has consulted on over thirty-two different litigation matters, testified in six depositions, and provided expert witness testimony in two trials. His experience as a valuation and economic damages expert witness has helped the parties settle over 80% of cases without going to trial. On the two matters that did go to trial, Jackim’s clients won both matters on the merits, with the judge stating in one case that Jackim’s testimony was clear and convincing and could not be refuted by the opposing expert witness.

Rich has worked with clients of all sizes, from individuals like business owners, doctors, and other professionals negotiating a divorce settlement to calculating economic damages for large organizations, like Rogers Sports & Media Group in Toronto and Applebee’s restaurants.

The Right Expert Witness Wins Cases

We encourage clients and their attorneys to contact us as early as possible. Early collaboration provides us with an opportunity to help you develop your litigation strategy. Ideally, we would be engaged early enough to assist in formulating requests for discovery. As a well-versed damages expert, Rich Jackim knows what information is needed to ensure a thorough and supportable analysis. In addition, engaging us early in the process allows time to help you think through the issues and help develop the most cost-effective strategy to present your case.

In the event we find we cannot support your position based on the information provided, knowing this early on can give you time to either revise your strategy or find a different expert. Remember, unlike attorneys who are advocates for their clients, the best expert witnesses should be a neutral third party whose professional opinion is objective and unbiased. Jackim has built an impeccable reputation by providing clients and their attorneys with honest, objective advice based on the available facts and his years of investment banking, law practice, and business ownership experience.

A copy of Rich Jackim’s expert witness curriculum vitae is available here.

For a free initial consultation, please contact Richard Jackim at rjackim@jackimwoods.com or at 224-513-5142.

Read More

Calculating the Pre-Money Value of an EdTech Company

What Is a Pre-Money Valuation?

One of the first questions I get from potential clients is how do you calculate the pre-money value of an EdTech company.

A pre-money valuation refers to the value of a company before it receives any external funding from investors. Put another way; a pre-money valuation is how much a company is worth before you start your capital raise. Angel investors and venture capital firms use a company’s pre-money value to determine what their investment in the company is worth.

Key Points

- A pre-money valuation is the value of an EdTech company before it receives an investment from an external investor.

- Potential investors use a company’s pre-money value to determine its worth before investing in it.

- Post-money valuations are different from pre-money valuations. A post-money valuation estimates a company’s value after it receives funding.

- This article was written for founders and managers of EdTech companies, but the same concepts apply to any business seeking angel investors or venture capital funding.

Understanding Pre-Money Valuation

Pre-money is the valuation of a company before a round of financing and gives investors a picture of the company’s current value. Pre-money values are determined before each round of funding a company receives. You can and should re-evaluate your pre-money valuation each time you seek seed, angel, Series A, B, or C round of venture funding.

How To Calculate a Pre-Money Valuation

The management team of the company seeking funding typically proposes a pre-money valuation to potential investors. However, “value is in the eye of the investor,” so each potential investor will have their own idea of the company’s pre-money valuation.

Calculating the pre-money valuation for a company is pretty straightforward. Here’s the basic formula:

Pre-Money Valuation = Post-Money Valuation – Investment Amount

So, if an EdTech company’s post-money valuation is $30 million after receiving a $10 million investment has a pre-money valuation of $20 million.

As you can see, a company’s pre-money valuation is heavily dependent on the company’s post-money valuation, so I encourage you to read my article “How to Value an EdTech Company: Multiples & Example.” In that article, I describe in-depth how to calculate a company’s post-money valuation and provide real-world multiples and an example.

Remember that the pre-money valuation is the basis for determining the amount of funding that investors are willing to provide and how much of the company’s equity they want in return. The company’s management team might propose one value and talk to dozens of potential investors before finding an investor who agrees with the company’s estimate of value. In most cases, the actual pre-money valuation used is heavily negotiated between the investors and management.

Things to Consider

First, remember that an EdTech company’s pre-money valuation is not a static number. That means it can and does change day by day. That’s because a company’s post-money valuation, and hence its pre-money valuation, are affected by general market demand, the public stock market, interest rates, investor appetites, and the company’s performance.

Next, remember that a pre-money valuation is done before each round of funding a company seeks. The pre-money value of an EdTech business will change based on the financing round (i.e, risk level), performance of the company, and market conditions. If a company is growing nicely and hitting its targets, its pre-money value should increase with each financing round, despite the increased investment required.

Third, remember that a pre-money valuation is still possible on early-stage EdTech companies that are pre-revenue, meaning the company has not generated any sales yet. In a pre-revenue company, investors will base its pre-money valuation on a combination of other value factors, including valuations of comparable businesses, projections, growth rates of similar companies, etc. Investors often use insider knowledge of the revenue and market potential of other more established, mature companies in the same sector or that have a similar business model to predict how successful a company will be.

Fourth, even if your EdTech company claims it has created a new industry with new unique solutions, and a new business model, investors will still calculate its value based on the businesses they already know.

Fifth, investors often say, “we invest in people, not companies,” and that’s true. The pre-money valuation of your EdTech company will be greatly affected by the experience and track record of its founders and management team and the likelihood that they will deliver on their promises.

Post-Money vs. Pre-Money Valuations

As its name implies, a post-money valuation differs from a pre-money value because it indicates how much a company is worth after receiving an investment.

To calculate the post-money valuation, please see my article “How to Value an EdTech Company: Multiples & Example.” In that article, I show you how to calculate the post-money value of your EdTech company, so you can figure out how much money you can potentially raise from investors.

Example of Pre-Money Valuation

In that article, I used an example of an EdTech company that determined it had a post-money value of $2.3 million. I also assumed that management projected it needed $1 million in seed money from investors to hit its revenue goals and achieve its exit value.

So, if we assume that the post-money valuation is $2.3 million and the company needs $1 million in seed money, that implies the founders and management team will potentially need to give up 44% of their equity to raise $1 million in growth capital.

That also implies the company’s pre-money value is $1.3 million, because, as we learned above, the pre-money value of your business is calculated as follows:

Pre-Money Value = Post-money value – Investment Amount

$1,300,000 = $2,300,000 – $1,000,000

Understanding the relationship between pre-money and post-money values is important because it allows founders, management teams, and investors to calculate how much equity needs to be given up to incentivize an investor to invest.

About the Author and Jackim Woods & Co.

Rich Jackim is an education industry investment banker and educational industry entrepreneur, and former mergers and acquisitions attorney.

Rich Jackim is an education industry investment banker and educational industry entrepreneur, and former mergers and acquisitions attorney.

For the last 25 years, Rich has been providing boutique investment banking services to middle-market companies in the education sector.

Rich also founded a successful training and certification company called the Exit Planning Institute which he sold to a private equity group in 2012.

Rich is also the author of the critically acclaimed book, The $10 Trillion Dollar Opportunity: Designing Successful Exit Strategies for Middle Market Businesses.

Jackim Woods & Co offers skilled mergers and acquisitions advisory services to privately owned schools, colleges, and EdTech companies in both sell-side and buy-side transactions. Jackim Woods & Co has arranged over 100 successful transactions, ranging from less than one million to more than eighty million dollars in value.

If you own an education-related business and are interested in exploring your options, I would welcome an opportunity to speak with you. Feel free to contact me at 224-513-5142 or rjackim@jackimwoods.com.

Read More

2022 EdTech Valuation Multiples

2021 was a tough year for EdTech companies. Despite 2021 being another record year for investment in the EdTech sector, including high-profile IPOs for Duolingo, Udemy, Coursera, and Instructure, companies in the EdTech sector saw the value of their companies drop by as much as 40% in some cases.

In 2021 investors learned to take a more conservative approach to value EdTech companies after Udemy’s IPOs demonstrated that the public markets will not support crazy valuations. Udemy went public at a $4.0 billion valuation, but as of the start of 2022, its market capitalization was only $1.8 billion. Investors lost $2.2 billion by overvaluing Udemy. As a result, other EdTech companies like Coursera and Duolingo reduced their IPO valuations in 2021.

The sell-off of EdTech stocks in the second half of 2021, was largely fueled by concerns over lofty valuations, inflation, and rising interest rates. These same concerns also caused a sell-off that impacted all technology, software, and growth stocks.

2022 Public EdTech Valuation Multiples

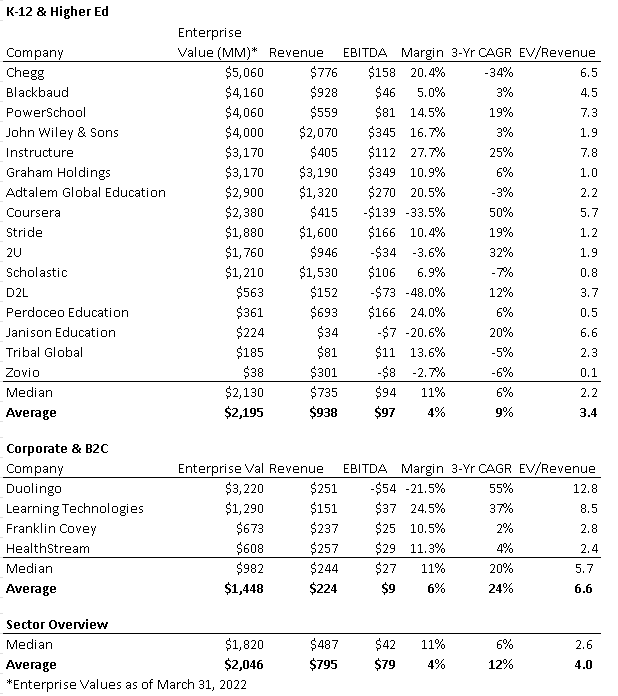

Despite the sell-off, EdTech companies are still trading at generous valuations. The table below shows the valuation multiples for a representative sample of publicly-traded EdTech stocks that we track.

As the data above indicates, the valuation of EdTech stocks varies depending on who the end-user is (K12 & Higher Ed vs B2C & Corporate). B2C and Corporate EdTech stocks sell for a higher multiple than Higher Ed and K12 companies.

As of March 2022, the median multiple of revenues for public Higher Ed & K12 EdTech companies was 2.2x and the average was 3.3, while the median multiple for public B2C & Corporate EdTech companies was 5.7 and the average was 6.6x.

Overall, the median revenue multiple for the entire publicly traded EdTech sector was 2.4x and the average was 3.9x.

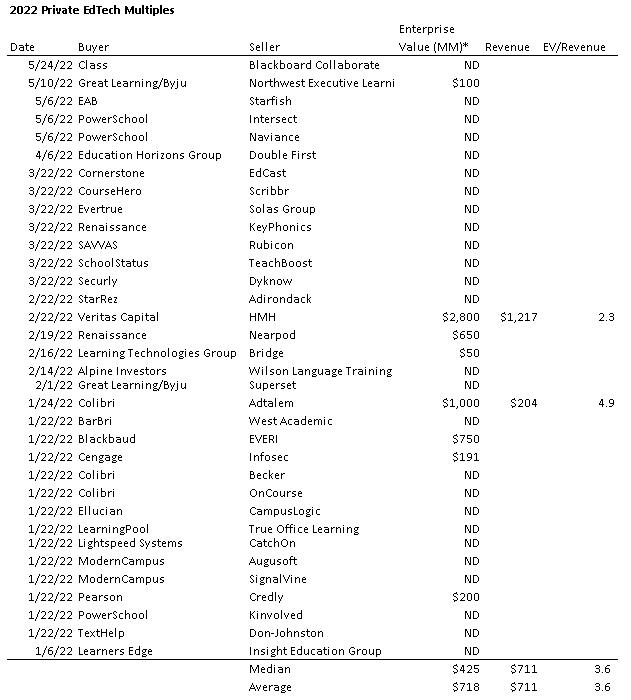

2022 Private EdTech Multiples

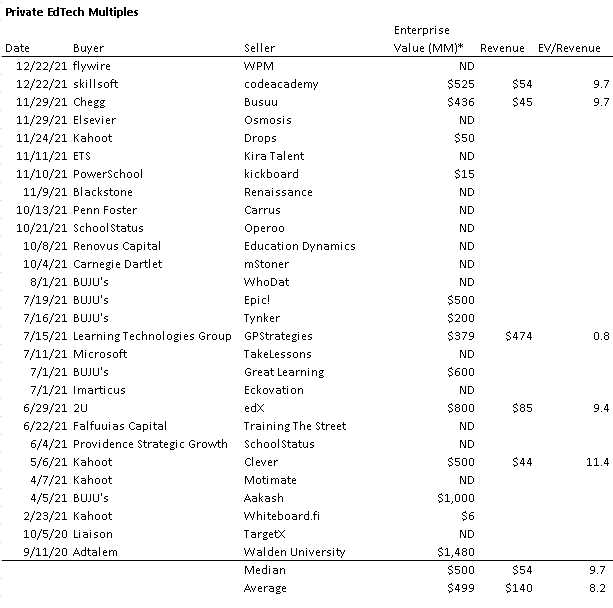

The selloff in the public markets also affected private EdTech multiples. The following table shows the 2022 private EdTech transactions Jackim Woods & Co tracks and the associated valuation data.

The following table shows similar data from 2021 when EdTech stocks experienced a COVID-related boost to their valuations.

A comparison of the data in the tables above shows that the median revenue multiple for private EdTech companies dropped from 9.7x in 2021 to 3.6x in 2022. Similarly, the average multiple of revenue for private EdTech companies dropped from 8.2x in 2021 to 3.6 in 2022.

2022 EdTech Private Company Valuation Multiples

Revenue multiples for private EdTech companies in early 2022 range between 2.0x and 5.0x, with a median of approximately 3.6x revenue.

Despite the macro conditions mentioned above, we expect the EdTech sector to continue to do very well in response to a growing global demand for new and better ways to deliver educational content from K12 to higher ed, to corporate training and lifelong learning.

As a result, we expect valuation multiples to remain strong for privately owned EdTech companies that are looking to raise growth capital or have a liquidity event. In addition, we expect that multiples for publicly traded EdTech companies will increase once inflation is under control.

About the Author and Jackim Woods & Co.

Rich Jackim is a mergers & acquisitions attorney, investment banker, and educational industry entrepreneur. In 2016 he founded the Exit Planning Institute, a very successful corporate training and certification company that he sold to a private equity group in 2012.

Rich Jackim is a mergers & acquisitions attorney, investment banker, and educational industry entrepreneur. In 2016 he founded the Exit Planning Institute, a very successful corporate training and certification company that he sold to a private equity group in 2012.

For the last 25 years, Rich has been providing boutique investment banking services to middle-market companies in the education sector.

Jackim Woods & Co offers skilled mergers and acquisitions advisory services to privately owned schools, colleges, and EdTech companies in both sell-side and buy-side transactions. Jackim Woods & Co has arranged over 100 successful transactions, ranging from less than one million to more than eighty million dollars in value.

If you are interested in exploring your options, I would welcome an opportunity to speak with you. Feel free to contact me at 224-513-5142 or at rjackim@jackimwoods.com.

Read More

Valuations for Title IV Schools and Training Companies at Record Highs

Valuations for vocational schools and training companies are at record highs now. As business performance rebounds, buyers are competing for strong performing businesses. That has led to an increase in the number of education-related businesses that were sold in Q3 of 2021. The number of education deals that closed in the third quarter increased 17% over the previous quarter, and 11% from the same quarter in 2020, according to Jackim Woods & Co, which tracks and analyzes vocational school and training company sale transactions.

2021 Education Industry Seller Confidence Index

Valuations for vocational schools and training companies are at record highs now because seller confidence is up. As the economy rebounds, owners of vocational schools and training companies are returning to the market, feeling more confident they can sell their schools and training companies for a good price and less willing to wait until the COVID pandemic is over. Seller confidence increased to 57 out of 70; that’s up from 45 in 2020. This is the highest seller confidence level since the high of 58 in 2018. Today 49% of the respondents believe they can receive a higher sale price for their school or training company today compared to a year ago, and 46% of respondents said the top factor motivating their confidence was an improvement in enrollment and revenue.

The average revenue for vocational schools and training businesses that were sold in the third quarter was $755,000, up 6% from the same time last year. Meanwhile, buyers of education-related businesses, especially Title IV schools, are paying record-high prices for businesses that performed well during the pandemic. The average sale price in the third quarter hit a new high of $1,780,000; that’s 17% higher than the previous year and 40% above pre-pandemic levels.

With current valuations above where they were pre-pandemic, many school owners are thinking now may be the right time to exit.

2021 Education Industry Buyer Confidence Index

Valuations for vocational schools and training companies are also at record highs because buyer confidence is up. Buyers noted that there is a limited supply of profitable well-run schools and training businesses on the market. In addition, several buyers noted that because of the shift to online learning, schools will be able to expand their geographic reach while reducing the cost of delivering educational services. The combination of these two factors signals significant growth opportunities and higher margins for well-run schools and training companies in the future. As a result, buyer confidence increased to 60, up significantly from 48 in 2020 and only slightly above the buyer confidence level of 59 in 2018.

It is interesting to note that demand for high-performing vocational schools and training businesses is increasing. According to Rich Jackim, Managing Partner of Jackim Woods & Co., “buyer inquiries on our education-related listings are up 39% since the same time last year. However, many business owners are putting off selling until their schools or training companies have fully recovered, so the supply of profitable, well-run schools is still limited. This is driving up values and makes it a sellers’ market.”

It is interesting to note that demand for high-performing vocational schools and training businesses is increasing. According to Rich Jackim, Managing Partner of Jackim Woods & Co., “buyer inquiries on our education-related listings are up 39% since the same time last year. However, many business owners are putting off selling until their schools or training companies have fully recovered, so the supply of profitable, well-run schools is still limited. This is driving up values and makes it a sellers’ market.”

If you are beginning to think about selling your training business or Title IV vocational school and would like to explore your options, please contact Rich Jackim at rjackim@jackimwoods.com for a FREE, confidential, no-obligation consultation.

Read More

Number of Acquisitions in Education Sector Soars in 2021

The total value of mergers and acquisitions in the education sector increased by more than 50% from the second half of 2020 to the second half of 2021, as companies across the industry rushed to add education-related companies to their portfolios, according to a report by mergers and acquisitions advisory firm, Jackim Woods & Co.

Jackim Woods & Co. is a mergers and acquisitions firm that provides advice and financial consulting to middle-market companies in the education sector.

The overall number of individual M&A transactions also rebounded to pre-pandemic levels.

Buyers of education companies closed 210 mergers in the first half of 2020, and 240 acquisitions during the first six months of 2021.

The total value of acquisitions in the education sector between January and June was $19.4 billion, largely driven by Platinum Equity’s $6.4-billion acquisition of McGraw Hill, the report noted.

The market value of deals closed during the first half of 2021 had almost as much market value as all the deals closed during all of 2020.

Private equity-sponsored transactions accounted for 40% of deals during the first six months of 2021. That’s 8% higher than the average number of private equity-backed deals for the last three years.

According to Jackim Woods & Co, 97 of the 240 deals during this time frame were sponsored or financed by financial investors like private equity, venture capital, or other investment firms. That’s the highest number in three years and a 130% increase over the first half of 2020.

Twelve deals during the first half of 2020 had purchase prices of more than $100 million, and at least seven of those involved the K-12 sector. About 33% of the deals had purchase prices of between $4.5 million and $54.6 million.

The K-12 EdTeh segment surpassed the professional training services sector as the education industry’s most active market segment in the first half of 2021.

Approximately 50 deals involved the acquisition of professional training companies in the second half of 2019 and about 45 deals covered professional training services in the first half of 2021. There were approximately 40 deals in the K-12 EdTech segment in the second half of 2020, while nearly 60 deals closed in that segment in the first half of 2021.

For other segments of the education sector, the analysis showed a mixed picture of market activity for the first six months of this year compared to the second half of 2020.

The number of deals in the childcare services and higher-education EdTech segments increased during this period, but the number of deals in professional training technology, higher-ed institutions (including Title IV vocational schools), and K-20 services decreased. Deals involving for-profit K-12 schools remained stable.

According to Rich Jackim, Managing Partner of Jackim Woods & Co, “we are seeing strong demand for Title IV vocational schools that prepare students for careers in the healthcare professions. We’re also seeing strong demand for non-Title IV schools, like commercial driving schools and cybersecurity and programming schools. Valuations for these schools have increased significantly over the last 24 months.”

In addition to the McGraw Hill acquisition, the most interesting education sector deals in the first half of 2021 included

- Byju’s $900 million acquisition of Indian tutoring company Aakash Educational Services

- Renaissance’s $650 million acquisition of Nearpod

- Kahoot’s $435 million acquisition of K-12 secure-sign-on provider Clever

If you own an education-related business, including a Title IV college or vocational school, a k-12 proprietary school, or an EdTech company and are beginning to think about selling, we would be delighted to speak with you and help you explore your options.

If you own an education-related business, including a Title IV college or vocational school, a k-12 proprietary school, or an EdTech company and are beginning to think about selling, we would be delighted to speak with you and help you explore your options.

Contact Rich Jackim, Managing Partner of Jackim Woods & Co at 224-513-5142 or rjackim@jackimwoods.com.

Read More