2022 EdTech Valuation Multiples

2021 was a tough year for EdTech companies. Despite 2021 being another record year for investment in the EdTech sector, including high-profile IPOs for Duolingo, Udemy, Coursera, and Instructure, companies in the EdTech sector saw the value of their companies drop by as much as 40% in some cases.

In 2021 investors learned to take a more conservative approach to value EdTech companies after Udemy’s IPOs demonstrated that the public markets will not support crazy valuations. Udemy went public at a $4.0 billion valuation, but as of the start of 2022, its market capitalization was only $1.8 billion. Investors lost $2.2 billion by overvaluing Udemy. As a result, other EdTech companies like Coursera and Duolingo reduced their IPO valuations in 2021.

The sell-off of EdTech stocks in the second half of 2021, was largely fueled by concerns over lofty valuations, inflation, and rising interest rates. These same concerns also caused a sell-off that impacted all technology, software, and growth stocks.

2022 Public EdTech Valuation Multiples

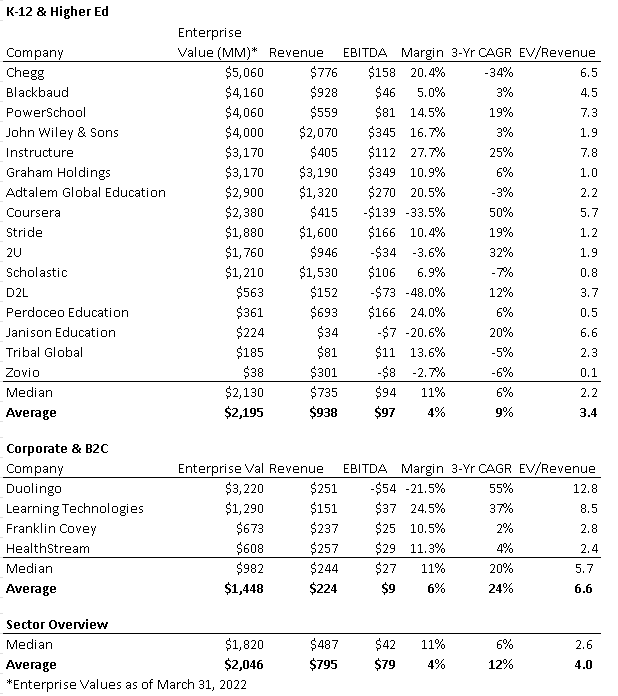

Despite the sell-off, EdTech companies are still trading at generous valuations. The table below shows the valuation multiples for a representative sample of publicly-traded EdTech stocks that we track.

As the data above indicates, the valuation of EdTech stocks varies depending on who the end-user is (K12 & Higher Ed vs B2C & Corporate). B2C and Corporate EdTech stocks sell for a higher multiple than Higher Ed and K12 companies.

As of March 2022, the median multiple of revenues for public Higher Ed & K12 EdTech companies was 2.2x and the average was 3.3, while the median multiple for public B2C & Corporate EdTech companies was 5.7 and the average was 6.6x.

Overall, the median revenue multiple for the entire publicly traded EdTech sector was 2.4x and the average was 3.9x.

2022 Private EdTech Multiples

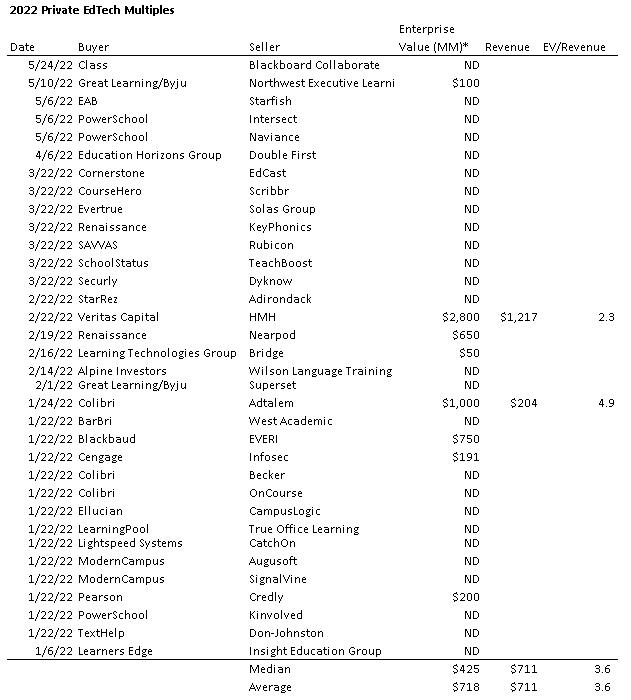

The selloff in the public markets also affected private EdTech multiples. The following table shows the 2022 private EdTech transactions Jackim Woods & Co tracks and the associated valuation data.

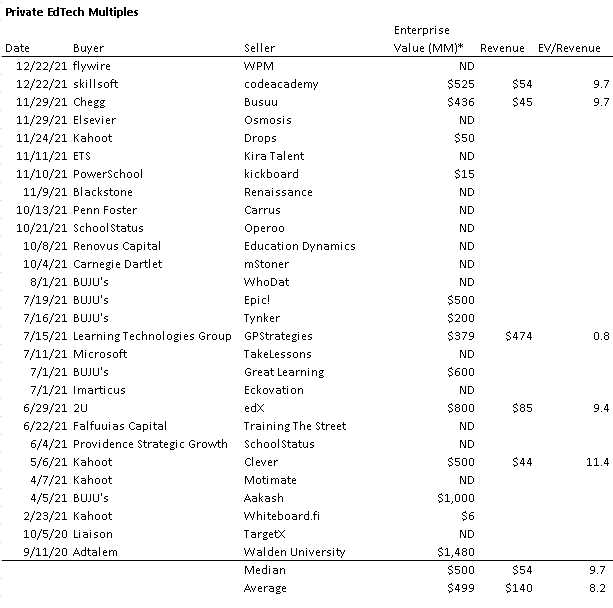

The following table shows similar data from 2021 when EdTech stocks experienced a COVID-related boost to their valuations.

A comparison of the data in the tables above shows that the median revenue multiple for private EdTech companies dropped from 9.7x in 2021 to 3.6x in 2022. Similarly, the average multiple of revenue for private EdTech companies dropped from 8.2x in 2021 to 3.6 in 2022.

2022 EdTech Private Company Valuation Multiples

Revenue multiples for private EdTech companies in early 2022 range between 2.0x and 5.0x, with a median of approximately 3.6x revenue.

Despite the macro conditions mentioned above, we expect the EdTech sector to continue to do very well in response to a growing global demand for new and better ways to deliver educational content from K12 to higher ed, to corporate training and lifelong learning.

As a result, we expect valuation multiples to remain strong for privately owned EdTech companies that are looking to raise growth capital or have a liquidity event. In addition, we expect that multiples for publicly traded EdTech companies will increase once inflation is under control.

About the Author and Jackim Woods & Co.

Rich Jackim is a mergers & acquisitions attorney, investment banker, and educational industry entrepreneur. In 2016 he founded the Exit Planning Institute, a very successful corporate training and certification company that he sold to a private equity group in 2012.

Rich Jackim is a mergers & acquisitions attorney, investment banker, and educational industry entrepreneur. In 2016 he founded the Exit Planning Institute, a very successful corporate training and certification company that he sold to a private equity group in 2012.

For the last 25 years, Rich has been providing boutique investment banking services to middle-market companies in the education sector.

Jackim Woods & Co offers skilled mergers and acquisitions advisory services to privately owned schools, colleges, and EdTech companies in both sell-side and buy-side transactions. Jackim Woods & Co has arranged over 100 successful transactions, ranging from less than one million to more than eighty million dollars in value.

If you are interested in exploring your options, I would welcome an opportunity to speak with you. Feel free to contact me at 224-513-5142 or at rjackim@jackimwoods.com.