Overview of Mergers and Acquisitions in the Education Sector 2019

2019-2020 saw a steady increase in M&A activity in the education sector. Strategic buyers and investors are scrambling to adapt to changes in learning modalities while private equity groups and financial buyers have shown renewed interest in the sector because of changes in the regulatory environment and the increased reliance on scaleable technology. In many instances, there is an ongoing shift from live, in-person instruction to an emphasis on online or blended instruction.

The K-12 education market remains active, as new technologies and services continue to improve student performance and teacher efficiency, improving overall educational outcomes. Companies that offer adaptive learning solutions and assessment products continue to have a meaningful impact. Advancements in online education, digital classrooms, specialized curriculum, and peer-to-peer sharing platforms are transforming the ways that students and teachers collaborate both inside and outside the classroom.

With the emergence of the COVID-19 pandemic and subsequent closure of schools worldwide, remote learning became more important than ever. Laptops and tablets have accelerated the pace at which students are utilizing digital tools and content, allowing the introduction of new entrants into the sector and compelling existing education providers to evaluate new technologies and teaching models. However, there is an uneven level of accessibility and preparedness for remote education in K-12 throughout the U.S.

The Higher-Ed sector has seen rapid advances in EdTech with online tutoring, instruction, proctoring, testing, grading, and assessment gaining traction and expanding rapidly. This includes rapid advances in automated online grading in subjects such as chemistry, math, and other quantitative disciplines. Recent developments in AI-based, automatic grading of essays and papers also garnered a lot of attention from investors.

Current M&A Market Landscape

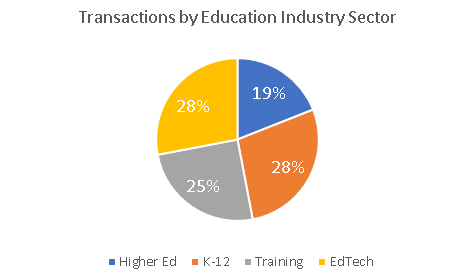

Jackim Woods & Co tracked over 900 education industry merger and acquisition (M&A) transactions beginning in 2018 through the end of 2019. Note that this covers all segments, including traditional brick-and-mortar higher ed and childcare services companies, as well as EdTech deals, which accounted for nearly half of the total transaction volume. K-12 EdTech/Media and Professional Training Services were tied as the industry’s most active market segments in 2019 with 90 transactions each. The total transaction volume increased nine percent between 2018 and 2019, while the average deal size declined somewhat. The total value of M&A transactions in the education sector declined 21%t, from $15.64 billion to $12.30 billion.

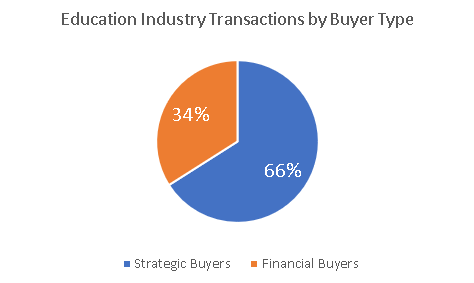

Strategic Buyers

• Strategic acquisitions saw a nine percent gain on an annual basis, from 292 to 318 deals. Strategic buyers accounted for 66% of transaction volume and 52% of transaction value in 2019.

Financial Buyers

• Private equity sponsored transactions in the education sector increased eight percent over the past year, from 149 to 161 deals. Financial buyers represented 34% of the transaction volume and 48% of transaction value in 2019.

• The education industry’s largest acquisition in 2019 was Thoma Bravo’s purchase of Instructure for $1.86 billion. Instructure developed the very popular and widely used Canvas learning management system (LMS).

• The most active overall buyer in the Professional Training segment was Leeds Equity Partners with four acquisitions, including Kaplan Altior, which delivers classroom-based, online and in-house skills training and assessments to the legal and professional services sectors; VitalSmarts, a communication and leadership development training business; The Center for Legal Studies, which offers online programs and training courses for paralegals and other legal support professionals; and Watermark Learning, a business analytics and project management training company.

Valuation Multiples

Enterprise value multiples in the education sector have been strong over the past 24 months.

The industry’s median revenue multiple rose from 1.8x to 2.5x, while the median EBITDA multiple declined from 10.5x to 9.6x. However, these statistics can be misleading, since revenue and EBITDA multiples vary widely by sector and the size of the company being acquired. For example, EdTech companies that accounted for the largest volume of M&A transactions over the last 24 months sell for much higher multiples than higher ed institutions, childcare services, and professional training companies, as illustrated below.

Higher-Ed Institutions

Title IV post-secondary institutions with EBITDA of less than $3 million sold for an average EBITDA multiple of 4.0, while larger institutions with EBITDA over $3 million sold for an average EBITDA multiple of 5.0.

K-12 Institutions

K-12, early childhood, and tutoring and test-prep service companies with EBITDA less than $3 million sold for an average EBITDA multiple of 4.5, while similar companies with EBITDA over $3 million sold for an average EBITDA multiple of 5.5.

Professional Training Services

Professional training and continuing education companies with EBITDA less than $3 million sold for an average EBITDA multiple of 4.5, while similar companies with EBITDA over $3 million sold for an average EBITDA multiple of 5.5.

EdTech

Companies with revenue of less than $3 million sold for an average revenue multiple of 1.9 or an average EBITDA multiple of 6.8. While EdTech companies with revenue over $3 million sold for an average revenue multiple of 2.8 or an average EBITDA multiple of 9.5.

Transactions Per Segment

Higher-Ed Institutions

Transactions in the Post-secondary, Higher-Ed Institutions sector increased 46%, making it the sector with the largest year-over-year increase. The segment’s highest value transaction in 2019 was YDUQS’ announced acquisition of Adtalem Educacional do Brasil for $472 million. YDUQS is Brazil’s second-largest private higher education organization. Adtalem Educacional do Brasil offers programs in healthcare, law, business management, engineering, and technology and serves more than 81,000 degree-seeking students. However, the vast majority of higher-ed transactions involved small and mid-sized Title IV career or vocational schools that were acquired by larger Title IV schools, as the industry consolidation continues to playout.

Childcare Services

Deal flow in the Childcare Services sector remained relatively constant. Spire Capital portfolio company O2B Kids, which has eight locations in the Southeast US, was a very active buyer with the acquisitions of Brookside Academy, The Village Academy, and Home Away Frome Home.

EdTech/Media

Transaction volume in the K-12 Media and Tech segment stayed nearly the same on a yearly basis. High profile segment acquirers during the past year included ACT with the acquisition of Mawi Learning, which provides a suite of social-emotional learning (SEL) tools and services for school districts; Houghton Mifflin Harcourt with the acquisition of Waggle, a web-based adaptive learning platform that provides differentiated Math and ELA instruction for students in grades 2 through 8; Scholastic with the acquisition of Make Believe Ideas, a UK-based publisher of children’s books; and Weld North with the acquisitions of Glynlyon, a digital curriculum company; and Assessment Technology, Inc. (ATI), a provider of instructional improvement and effectiveness technology.

Deal activity in the Higher-Ed Media and Tech segment underwent a 15% increase from 2018 to 2019. Notable acquisitions include John Wiley & Sons’ acquisition of Zyante, a provider of computer science and STEM education courseware; and Elsevier’s acquisition of Parity Computing, which uses artificial intelligence to transform raw STM content for publishers and researchers.

Professional Training and Services

In the Professional Training segment, the number of Technology deals increased 21%, while Services transactions underwent a 4% increase. A few notable acquisitions in the combined Professional Training segments included Wendel Group’s acquisition of Crisis Prevention Institute, which provides behavior management and crisis prevention training programs, and 2U’s acquisition of Trilogy Education Services, which offers skills-based training programs in high-demand tech fields at universities and companies.

Conclusion

The transformation occurring in the education sector bodes well for continued strong M&A activity in 2020 and 2021. Many educational institutions have built or acquired important platforms for students, faculty, and administrators to improve educational outcomes. At the same time, increasing utilization of data, the need for efficient interoperability of existing systems, and acceptance of technology that drives student outcomes or employee performance are all enabling factors that have helped to keep M&A volume healthy.

Additionally, system infrastructure spending in both K-12 and post-secondary sectors has become more of a priority among states, school districts, and institutions. The product offerings available for these markets have become more compelling in terms of cost savings, learning impact measurability, and system compatibility. The potential revenue has also created a high stakes environment that has encouraged larger software developers to enter the market by acquiring smaller competitors.

About Jackim Woods & Co.

Jackim Woods & Co. is an independent M&A advisory firm that provides M&A advisory to education-related businesses, including K-12 schools, Title IV career colleges, test-prep and tutoring firms, and continuing education/professional training companies.

Jackim Woods & Co. is an independent M&A advisory firm that provides M&A advisory to education-related businesses, including K-12 schools, Title IV career colleges, test-prep and tutoring firms, and continuing education/professional training companies.

The firm offers skilled mergers and acquisitions services to privately held businesses and buyers, including private equity groups, in both sell-side and buy-side transactions. The principals at Jackim Woods & Co have been involved in over 100 business sales, with a combined value of over $450 million.

If you own an education-related company and are interested in exploring your options, please contact Rich Jackim, Managing Partner at 224-513-5142 or rjackim@jackimwoods.com.

Read More2017 Business Owner Exit Planning Survey

The 2017 Business Owner Survey conducted by Jackim Woods & Co. provides some interesting insights how owners of privately held companies are thinking about ownership transition. 80% of the respondents to this year’s survey were between 45 and 70 years. The businesses they owned had reported revenues of between $500,000 to $75 million. The survey included responses from companies in the manufacturing, business and consumer services, and distribution sectors.

The survey showed that:

78% of business owners plan to exit their businesses in the next 10 years.

75% would exit today if the net proceeds were enough to ensure a comfortable retirement.

81% of business owners have no “heir apparent” or “internal successor” to take over the business.

How Prepared are Owners for an Exit?

It is interesting to note that despite the vast majority of business owners wanting to exit as soon as possible or within 10 years, very few have taken proactive steps to get prepared. This year’s study found that:

If you are beginning to think about your options, please feel free to contact us to learn more about the M&A process and how you can begin to prepare yourself and your business for a successful exit. In our 20+ years of experience working with business owners, we have learned that the most successful exits take sound planning and solid execution of that plan, so it’s never to early to begin a discussion with us.

Read MoreCamping World Acquires TheHouse.com

Camping World Holdings, a network of RV-focused retail locations, has announced to purchase TheHouse.com, an online retailer specializing in bikes, sailboards, skateboards, wakeboards, snowboards and outdoor gear.

Camping World Holdings, a network of RV-focused retail locations, has announced to purchase TheHouse.com, an online retailer specializing in bikes, sailboards, skateboards, wakeboards, snowboards and outdoor gear.

The acquisition will build on and complement the foundation already in place to serve customers across the Camping World RV SuperCenter network and positions the company for faster e-commerce growth by expanding customer reach and adding new product offerings. Camping World recently acquired certain assets of Gander Mountain, a leader in the hunting, fishing, camping and outdoor gear market and Overton’s, which features boating and marine accessories.

According to Camping World management, Camping World and TheHouse.com will maintain distinct brands, with Camping World focusing on the outdoor camping and RV industry, while TheHouse.com continues to provide a unique experience for the active outdoor lifestyles.

This new acquisition, coupled with their recent acquisition of Overtons.com and GanderOutdoors.com, continues Camping World’s focus on serving the needs of outdoor enthusiasts and furthers the company’s strategy of diversifying their customer base.

Read More5 Ways to Maximize the Value of Your Private Security Company

Responding to the strong interest in security related companies from strategic and financial buyers, the Illinois Security Professionals Association (ISPA) asked Rich Jackim to write an article for its monthly newsletter on the 5 Ways to Maximize the Value of Your Private Security Company.

Responding to the strong interest in security related companies from strategic and financial buyers, the Illinois Security Professionals Association (ISPA) asked Rich Jackim to write an article for its monthly newsletter on the 5 Ways to Maximize the Value of Your Private Security Company.

Thor Industries Acquires Jayco, a Leading RV Manufacturer

Thor Industries acquired Jayco Corp. for approximately $576 million in cash. This transaction represents a unique and significant opportunity for Thor to enhance its growth through the acquisition of a major manufacturer of complementary products like travel trailers, folding camping trailers, higher-end diesel Class A motorhomes and larger Class C motorhomes.

Thor Industries acquired Jayco Corp. for approximately $576 million in cash. This transaction represents a unique and significant opportunity for Thor to enhance its growth through the acquisition of a major manufacturer of complementary products like travel trailers, folding camping trailers, higher-end diesel Class A motorhomes and larger Class C motorhomes.