Thinking of selling your injection molding business? The first question most business owners ask is “how much is my injection molder worth?”

The value of your plastic molding business is based on a combination of the value drivers listed below and a multiple of your company’s earnings before interest, taxes, depreciation, and amortization or EBITDA.

Value Drivers in the Plastics Molding Industry

The value of your injection molder, custom processor, or other engineered plastic component manufacturer depends on several value drivers, including:

- Size (revenues)

- Profitability (current and historical)

- Trends (over the last 5 years)

- Customers (including customer concentration)

- End markets (including industry concentration)

- Growth opportunities (including projections)

- Management team (depth & experience)

- Employees (tenure & expertise)

- Location

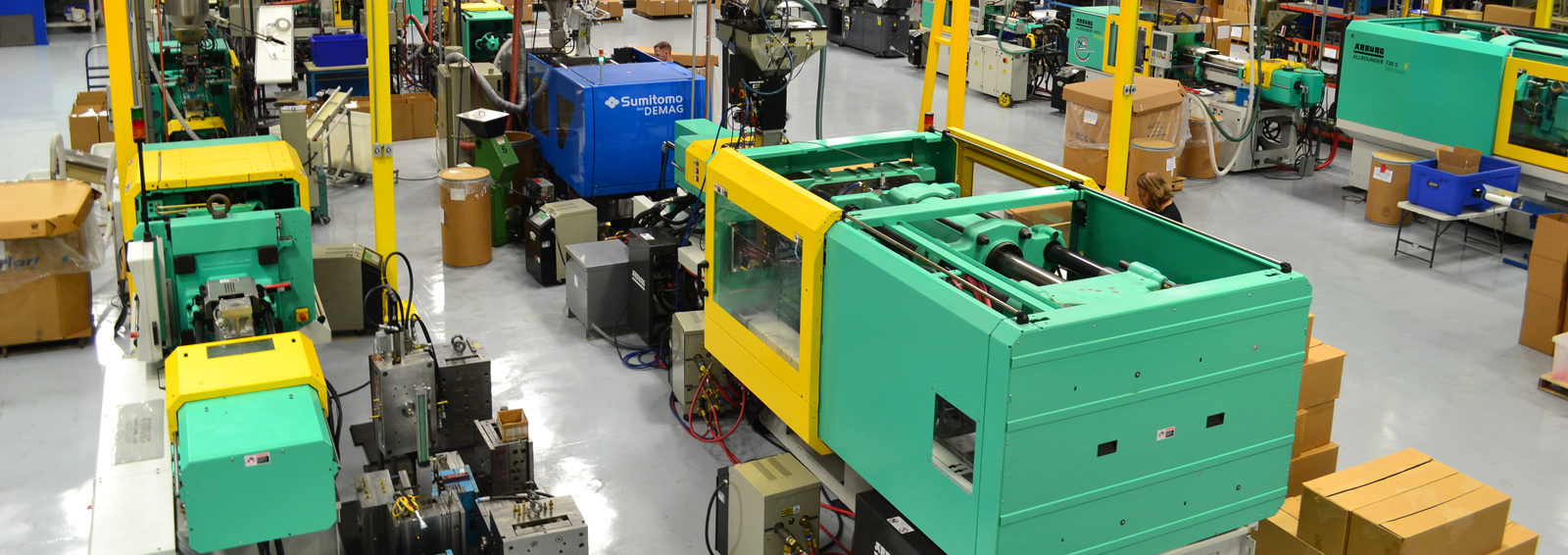

- Condition of your plant (interior & exterior)

- Capacity utilization

- Equipment (number and sizes of presses and auxiliary equipment

The Importance of EBITDA

But at the end of the day, most businesses, including injection molders, roto molders, thermoformers, dip molders, and mold & tool makers are valued based on a multiple of the cash flow they generate.

This cash flow is often referred to as earnings before interest, taxes, depreciation, and amortization or “EBITDA”. The value drivers listed above will influence whether the multiple used to value your business is at the high-end or low-end of the range.

Valuation Rules of Thumb

The rules of thumb provided below are used by business brokers, buyers, and bankers to get a ballpark idea of what an injection molding business is worth.

| EBITDA | SELLING PRICE |

| 0 – $50,000 | FMV of your equipment |

| $50,000 – $150,000 | 1.5-3.0 times EBITDA |

| $150,000 – $500,000 | 3.0-4.0 times EBITDA |

| $500,000 – $1,000,000 | 3.5-4.5 times EBITDA |

| $1,000,000 – $3,000,000 | 4.5-6.5 times EBITDA |

| $3,000,000 and up | 6.5-8.0 times EBITDA |

As you probably noted, the multiple buyers are willing to pay increases as your EBITDA increases. This is called the Size Premium. Buyers are willing to pay a premium for larger companies because a larger company usually suggests lower risk. That is because larger companies typically have larger customers, more sophisticated manufacturing processes, better financial records, and more management bench strength.

What Does the Selling Price Include?

The selling price includes the following:

- All of the equipment, fixtures, and other assets that are necessary to run your molding operation

- The net working capital of your business, including your inventory, accounts receivable and accounts payable

- The assumption that your injecting molding business will be sold on a cash-free, debt-free basis

The selling price does NOT include the following:

- The value of your real estate (if you own the building you occupy)

- The excess cash on your balance sheet

If you own the real estate and are currently paying yourself fair market rent, you can include the real estate in the sale of your injection molding business, or sell it separately at its fair market value.

Keep in mind that most buyers of your injection molding business will not be interested in buying your real estate. Very often they will be interested in either leasing your space or consolidating your operations into space they already have.

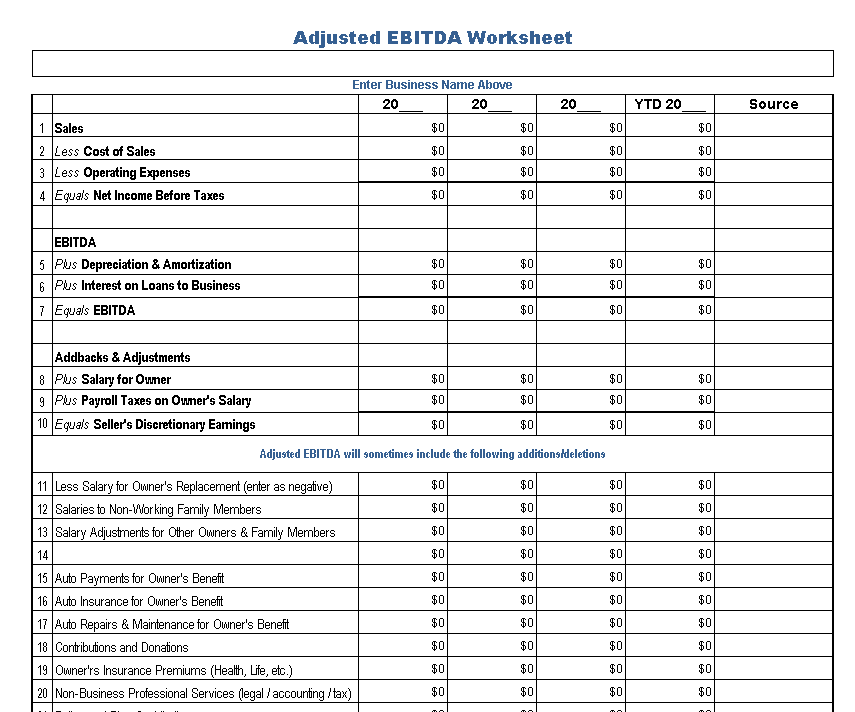

How to Calculate the EBITDA of your Injection Molding Business

To calculate the earnings before interest, taxes, depreciation, and amortization or EBITDA of your injection molding company, start with the net profit from operations shown on your P&L statement or tax return, then add back interest, depreciation, and amortization. This is your EBITDA.

The next step is to adjust your EBITDA to add back all the perks and benefits that come with owning your own business. This includes the ability to pay yourself an above-market salary and perks that a new owner would not incur. These are called Owner Adjustments and it’s important to add these back to your EBITDA because they are often sizable.

Next, it’s also important to add any one-time or non-recurring expenses to your EBITDA. Some examples are the cost of a piece of equipment that you expensed, or the cost related to an acquisition or sale of a business, or professional fees related to an audit or litigation. These are expenses that a new owner will not incur, so it’s important to identify these and add them back to your EBITDA because they can be significant.

Finally, if you own the building your injection molding operation occupies, you may be paying yourself above or below-market rent. To get an accurate valuation, your EBITDA needs to be adjusted to reflect the fair market rent a buyer would pay when they own your business.

Because it is essential to have an accurate idea of what your adjusted EBITDA is in order to value your injection molding operation, we’ve included a FREE worksheet you can use to calculate your own adjusted EBITDA.

Rich Jackim, is the founder of Jackim Woods & Co and the Exit Planning Institute. He’s also the author of

Rich Jackim, is the founder of Jackim Woods & Co and the Exit Planning Institute. He’s also the author of