Court Reporting & Litigation Support Industry is Ripe for Consolidation

By Richard Jackim, JD, MBA, CEPA

Managing Partner, Jackim Woods & Co.

The litigation support industry and the court reporter sector, in particular, is a highly fragmented industry dominated by hundreds of small local, state and regional players. While there are several dozen national and international firms, no single firm has more than 5% of the overall market. Over the last ten years, a handful of well-financed litigation support companies have been quietly acquiring local and regional court reporting firms to build their national and international litigation support platforms. The dramatic increase in the number of court reporter acquisitions over the last few years suggests that the consolidation play is still top of mind for many financial and strategic buyers. We have included a summary of the court reporting companies that have sold recently.

We firmly expect the wave of court reporting firm acquisitions to continue and for it to remain a seller’s market for the foreseeable future. There are several reasons for this increase in M&A activity in the court reporting industry.

Aging Owners

The first reason is that most owners of court reporting firm are in their late 50’s or older and are beginning to think about retirement. For these owners, selling the company to another entity allows them to take some money off the table, continue to work for a few years, and guarantee jobs and benefits for the trusted employees who work for them for years.

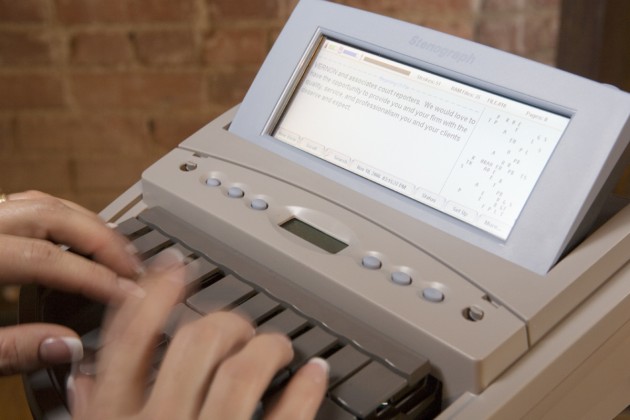

Shortage of Court Reporters

Next, the wave of consolidation is likely to continue due to the increased demand for court reporting and litigation support services combined with a decrease in the number of people entering the court reporting profession. This points to a severe shortage of court reporters for the foreseeable future. To grow, a court reporting agency needs to employ more court reporters and if you can’t recruit them fast enough, the next best option is to acquire an existing court reporting firm and add that firm’s reporters to your roster. This accomplishes two important goals: acquiring trained and productive employees and gaining a loyal local client base at the same time.

Changes in Technology

The third reason the court reporting industry consolidation makes sense is the changing nature of the demand for their services. The continued cost pressures on courts, law firms and their clients are forcing these consumers of court reporting services to change their business practices. More than 45 states now accept digital recordings (both audio and video) in the courtroom. The adoption of new technologies can assist the court reporter in producing an accurate record of proceedings, but this requires a significant investment on the part of the court reporting firms which may not be possible for many smaller firms. It’s important for a company to have invested in and maintained cutting-edge utilization of technology as a competitive advantage. Any company can buy technology. But it takes good management, skills training of employees, and a dedication to optimizing technology (machinery, automation, software, etc.) to turn an investment in hard assets into real value for the company. Technology also provides a way for companies to vertically integrate into complementary capabilities and extend their reach to new customers.

Changes in Client Requirements

In addition, consumers of litigation support services are increasingly looking to reduce the number of vendors they work with and find economies of scale in their operations. Clients are increasingly looking for one firm that can provide them with a comprehensive set of litigation support services including, court reporting services, eDiscovery services, document management and storage solutions, video conferencing, and other litigation support services. This is especially true for the large national and international law firms and insurance companies that are the biggest users of litigation support services.

Low-Risk Solution

The fifth reason the consolidation wave will continue is that despite advances in technology, court reporting is at its heart a service that is delivered locally. You need to have a presence in the local market, meet with clients, and provide services locally. When a court reporting company is interested in entering new markets, either in terms of geography or a new industry sector, it is usually safer and faster if it is done through an acquisition. A company that is entrenched in a local market and has a good reputation, a solid and diverse customer base in that market or that region, and has the right size, technology and management, can be attractive to a larger company that wants to become a player in that market.

Size Matters

The last reason the consolidation will continue is that size matters. Size tends to indicate the strength of a company. In most cases when a company has grown to a considerable size —say a firm with 200 court reporters that generates $20 million in revenue—it has done so because of good management, a good reputation in the markets it serves, and an effective use of technology. This doesn’t happen by accident, and as a result, buyers and financial investors are willing to pay a premium for these companies. So, if a regional court reporting firm can acquire 1-2 local competitors a year and pay 3-4 times cash flow for each of them over the course of five years, that regional court reporting firm could be worth 4-5 times cash flow when it comes time to sell.

Below is a summary of 38 sales of court reporting firms over the last few years. This is a partial list that reflects only the publicly announced deals. Since most transactions are private, we estimate there is an equal number of deals that were not reported.

Recent Sales of Court Reporting Firms (2019-2024)

The consolidation of the court reporting industry is apparent when you look at the number of court reporting acquisitions that have closed recently. For a list of the publicly announced court reporting deals over the last several years, please see our article entitled: Acquisitions in the Court Reporting and Litigation Support Sector.

Older Acquisitions of Court Reporting Firms

David Feldman Worldwide Court Reporting, 2018

Gramann Reporting, 2018

Stenotrain, 2018

Tayloe Court Reporting, 2018

Amicus Court Reporters, 2017

Ayotte & Shackelford, 2017

Baltimore Court Reporting, 2017

Barrister Reporting Service, 2017

Carpenter Reporting, 2017

Cook & Wiley, Inc., 2017

Deitz Court Reporting, 2017

Dominion Reporting, 2017

Downtown Reporting, 2017

Everman & Everman, 2017

Friedman, Lombardi & Olson, 2017

Hoorwitz Court Reporting, 2017

Litigation Services, 2017

Wheeler & Hallford Court Reporting, 2017

Bienenstock Nationwide Court Reporting, 2016

Brunson Court Reports, 2016

Gregory Court Reporting Service, 2016

Independent Reporting Services, 2016

Lake Shore Reporting, 2016

Love Court Reporting, 2016

MJC Reporting, 2016

Sclafani Williams Court Reporters, 2016

Sperling & Barraco, 2016

Realtime & Court Reporting, Ltd, 2015

Elisa Dreier Reporting, 2015

M.A.R. Reporting Group, 2015

Shelley Plate Reporting, 2015

All Keys Reporting, 2014

Legal Ease Reporting, 2014

Medrecs, 2014

Electronic Legal, 2013

Tooker & Antz Reporting, 2013

American Realtime, 2012

Carol Ann Hargreaves Company, 2006

About the Author

Rich Jackim is an experienced investment banker and a former attorney who practice law with White & Case in New York and overseas. He specializes in advising business and professional services firms in mergers and acquisition transactions across the United States. If you own a court reporting or litigation support company and would like to explore your options, please contact him at rjackim@jackimwoods.com or at 224-153-5142 for a free, no-obligation consultation.

Rich Jackim is an experienced investment banker and a former attorney who practice law with White & Case in New York and overseas. He specializes in advising business and professional services firms in mergers and acquisition transactions across the United States. If you own a court reporting or litigation support company and would like to explore your options, please contact him at rjackim@jackimwoods.com or at 224-153-5142 for a free, no-obligation consultation.